Grand Rapids & Kalamazoo Tax Fraud Attorney

Tax fraud is a federal crime taken very seriously by federal prosecutors, who use all the resources at their disposal to pursue convictions that come with harsh penalties, including time in federal prison, large fines, tax penalties and crushing interest. If you have been charged with tax fraud or are currently under investigation, it is crucial to have an experienced tax fraud lawyer in Kalamazoo & Grand Rapids protecting your interests.

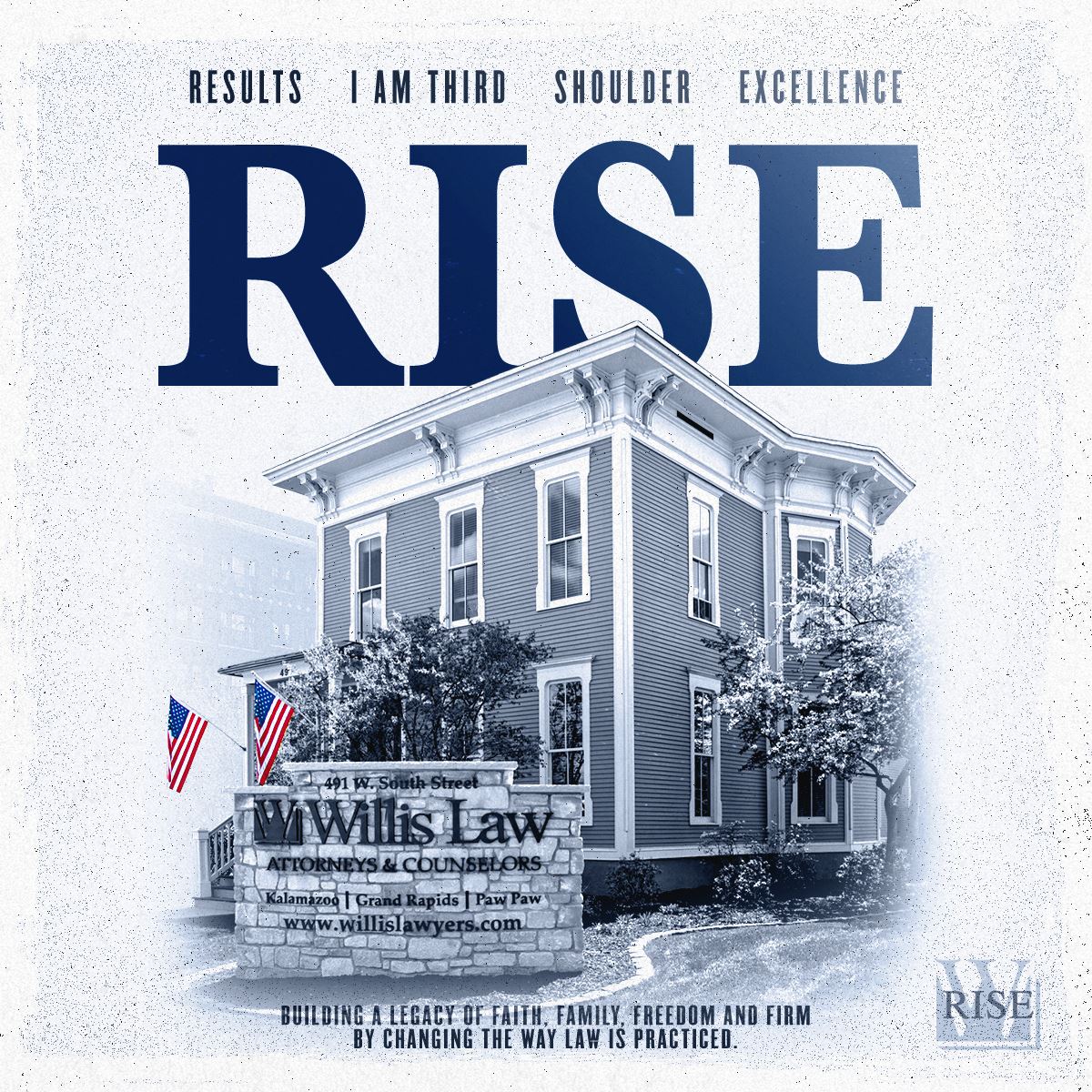

At Willis Law, we provide skilled tax fraud defense representation to our individual and corporate clients throughout West Michigan. You can rely on our team of strong trial lawyers and negotiators to pursue the outcome that best protects your rights, your record and your reputation.

Tax Evasion Defense Lawyers

Our IRS fraud lawyers defend individuals and business entities against a variety of tax fraud charges, including:

- Tax evasion

- Sales tax fraud

- Payroll tax fraud

- Failure to file returns

- Filing false returns

- Offshore account fraud

- International income fraud

These are complex issues that require the attention of a meticulous team of attorneys. That is exactly what you will find at Willis Law. We are thorough and efficient, making sure that our clients are fully prepared for the process before them and that the prosecution will not have any information at its disposal that we are not aware of.

Timing Is Critical in Tax Fraud Cases

When we are bought into a case early enough, we are often able to negotiate compromises that result in the matter being handled in civil court, rather than through the criminal justice system.

To learn more about how our Kalamazoo tax fraud attorneys can help you protect yourself, contact us today for a free initial consultation. We have office locations in Kalamazoo, Grand Rapids and Paw Paw.

Meet Your Legal Team

Helping You Achieve the Best Possible Outcome

-

Michael Willis J.D., C.P.A. Director and Co-Founder

Michael Willis J.D., C.P.A. Director and Co-Founder -

Shaun Willis J.D. Director and Co-Founder

Shaun Willis J.D. Director and Co-Founder -

Frank Willis J.D. Chief Senior Counsel

Frank Willis J.D. Chief Senior Counsel -

Donald Smith, J.D. Attorney/Partner

Donald Smith, J.D. Attorney/Partner -

Mariko Willis, J.D. Of Counsel Attorney

Mariko Willis, J.D. Of Counsel Attorney -

Samuel Gilbertson J.D. Managing Partner

Samuel Gilbertson J.D. Managing Partner -

Davis Martin, J.D. Counsel

Davis Martin, J.D. Counsel -

Paul Morgan, J.D. Senior Counsel Attorney

Paul Morgan, J.D. Senior Counsel Attorney -

Chico Obande J.D. Attorney

Chico Obande J.D. Attorney -

Jennifer Grahek, J.D. Attorney

Jennifer Grahek, J.D. Attorney -

Aric Kasel, J.D. Attorney

Aric Kasel, J.D. Attorney -

Cody Hayward, J.D. Attorney

Cody Hayward, J.D. Attorney -

Austin Beaudet Attorney

Austin Beaudet Attorney -

Adam Bancroft, J.D. Counsel

Adam Bancroft, J.D. Counsel -

Verelle Kirkwood J.D. Of Counsel Attorney

Verelle Kirkwood J.D. Of Counsel Attorney -

Kristyn Meulenberg J.D. Of Counsel Attorney

Kristyn Meulenberg J.D. Of Counsel Attorney -

Nicholas Vogelzang Of Counsel Asbestos Litigation Attorney

Nicholas Vogelzang Of Counsel Asbestos Litigation Attorney -

Robin Vleugel Receptionist

Robin Vleugel Receptionist -

Michele Guyman Paralegal

Michele Guyman Paralegal -

Brian Thompson Paralegal

Brian Thompson Paralegal -

Patty Stickels Legal Assistant

Patty Stickels Legal Assistant -

Kay Davidson Legal Assistant

Kay Davidson Legal Assistant -

Karen Zimmerman Legal Assistant

Karen Zimmerman Legal Assistant -

Robert Wilson Chief Financial Officer

Robert Wilson Chief Financial Officer -

Mark Zigterman Accountant

Mark Zigterman Accountant -

Margarita Jensen Intake Coordinator

Margarita Jensen Intake Coordinator -

Patrick Willis Courier

Patrick Willis Courier

[2].1911210950550.jpg)

.2208291210550.jpg)