How to Calculate FTE for Cares Act

Under the Paycheck Protection Program of the Coronavirus Aid, Relief, and Economic Security Act, what is the appropriate equation for a company to use in determining its number of full-time equivalent employees?

Short Answer

When calculating the number of full-time equivalent employees, an employer should use the following equation: (Number of Employees who average 30 hours per week or more over the course of a month) + (Total hours worked by all part-time employees that month / 120).

Analysis

The Coronavirus Aid, Relief, and Economic Security Act (hereafter, “CARES Act”) provide small businesses the opportunity to apply for a loan under the Paycheck Protection Program (hereafter, “PPP”) that may later be forgiven in whole or in part. The maximum loan amount a business is eligible to receive a loan, up to $10,000,000 to assist in facilitating business operations during an eight-week period. 2020 Enacted H.R. 748 § 1102(a)(2)(E).

An employer who receives a loan under the PPP is then eligible to have that loan forgiven in whole or in part after the covered period expires. The covered period when determining the portion of the loan eligible for forgiveness is an eight-week period beginning on the date of origination of the covered loan. Id. at § 1106(a)(3).

In determining eligible forgiveness, the employer must calculate the sum of payroll, interest on a covered mortgage obligation (excludes payment on principal), rent payment, and utility payments. Id. at § 1106(b). The maximum forgiveness will either be this amount, or the principal on the loan, whichever is less.Id. at § 1106(d)(1)

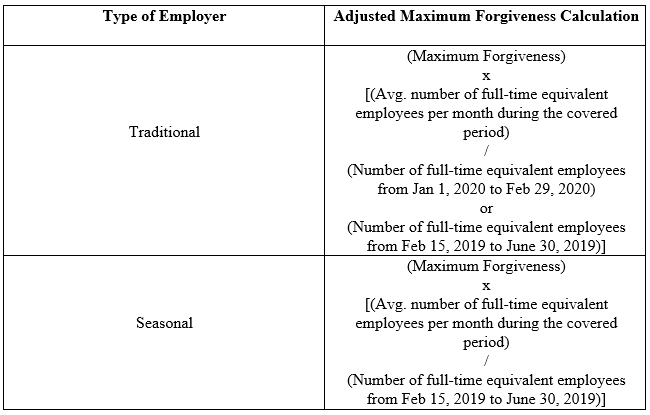

The employer can then take the remaining amount which will be adjusted by the calculation shown in Table 1, below. Id. at § 1106(d)(2). The amount calculated in Table 1 may not result in an increase in the maximum loan forgiveness calculated above.

Table 1: Full Time Equivalent Employee Reduction in Loan Forgiveness

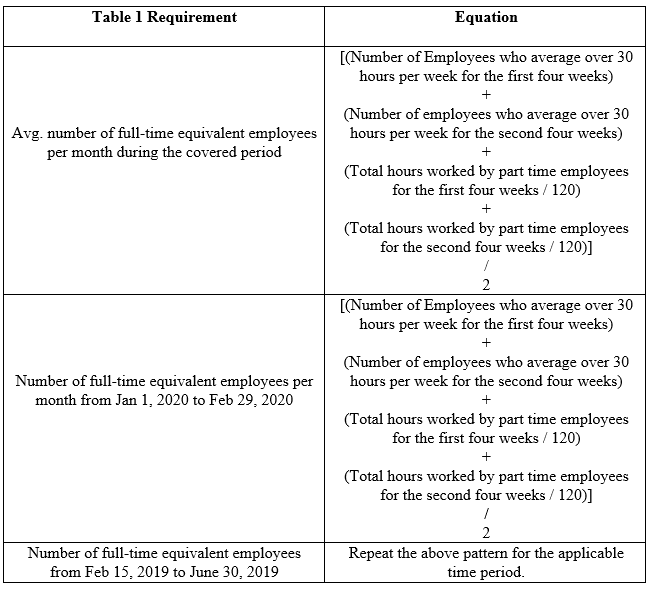

In determining the loan forgiveness reduction under this section, an employer must first be able to determine the number of full-time equivalent employees (hereafter, “FTE’s”) for each respective time period. The PPP does not provide any guidance on the appropriate way to calculate the number of FTE’s. There is only one section of the CARES Act that references the definition of a full-time employee or FTE. The section deals with an employee retention tax credit for employers and refers to Internal Revenue Code Section 4980H for the definition of a full-time equivalent employee. Id. at § 2301(c)(3). Under this section, a full-time employee is defined as an employee who in any given month is employed, on average, at least 30 hours per week. 26 USC § 4980H(c)(4)(A). An employee who works over 30 hours is considered one FTE under this section. Id. at § 4980H(c)(2)(E). Part-time employees are also taken into consideration when determining the number of FTE’s employed by any business. In determining the number of FTE’s for a given month using part-time employees, an employer should add up all the hours worked by part-time employees and divide that number by 120. Id. Table 2, below, shows the equations that should be used in finding the number of FTE’s required to complete the calculations in Table 1.

Table 2: Equations for Calculating FTE’s

Some employers, although not seasonal, are much busier in a particular season, which results in their employees working many more hours during a certain time period than they otherwise would. This scenario is accounted for by allowing this type of employer to select the period in which they would like to compare their number of FTE’s to the number employed during the covered period. Employers can elect to calculate their number of FTE’s from Jan. 1, 2020, to Feb. 29, 2020, or from Feb. 15, 2019, to Jun. 30, 2019. The elected time period should be chosen according to the information above. During their busy time periods, these employers often have employees working 60+ hours per week. These employees, although working double the number of hours required to be an FTE, are considered one FTE. Id. The equations in Table 1 allow for a non-seasonal employer to elect which time period they would like to choose in determining the number of FTE’s. For purposes of maximizing the amount of the loan eligible for forgiveness, the employer should calculate the number of FTE’s for both periods and select whichever one is smaller. Selecting the smaller number will result in a smaller denominator in the equation, which in turn results in less of a reduction in loan forgiveness. For example, if the average number of FTE’s during the covered period for an employer is 20, and the number of FTE’s for one of the time periods is 25, the calculation for a loan with a balance of $5,000,000 would be: ($5,000,000) x (20/25) = $4,000,000. Now, assume the number of FTE’s for the other time period is 28. The calculation would then become ($5,000,000) x (20/28) = $3,571,428. This example illustrates just how dramatically the maximum loan forgiveness can be affected based on which time period an employer elects for their calculations.

There is another reduction that must be made after the calculations in Table 1 are completed. The adjusted maximum forgiveness calculation may then be reduced by subtracting the salary reductions or certain employees. An employee who makes less than $100,000 per year whose salary during the covered period is cut by 25% or more will result in a decrease in the forgiven amount of the loan. 2020 Enacted H.R. 748 § 1106(d)(3). The employee’s salary is determined from wages earned in the most recent full quarter before the covered period. Id. The reduction in loan forgiveness is the Adjusted maximum forgiveness minus the total decrease in wages for these employees. Id.

Conclusion

The information discussed above is the appropriate calculations for the time. The SBA has not issued guidance on how to calculate the number of FTE’s for purposes of the PPP. An employer who has taken out a loan and wishes to have it forgiven should stay vigilant and up to date on any guidance, the SBA may issue. While most of the calculations are clearly laid out in the CARES Act, the calculation for FTE’s is not. It is possible the SBA may issue guidance on how to appropriately calculate the number of FTE’s for purposes of the PPP. Further, it is possible the new calculation would be inconsistent with the one listed above. For now, when calculating the number of full-time equivalent employees, an employer should use the following equation: (Number of Employees who work average 30 hours per week or more over the course of a month) + (Total hours worked by all part-time employees that month / 120).