COVID-19 Laws in Michigan

Dear Clients,

We understand that issues regarding novel coronavirus (“COVID-19”) have created a great deal of uncertainty and anxiety with local business, the economy and with our country as a whole. This correspondence is meant to alleviate some of the uncertainty and to begin a dialogue in regard to new laws which have been recently passed in response to COVID-19.

There are two laws directly impacting your business or your employer. These laws are Families First Coronavirus Response Act (“FFCRA”) and Executive Order 2020-21 (“Shelter in Place - MI”). On March 18, 2020, President Donald Trump signed FFCRA into law. The FFCRA seeks to assist employees impacted by COVID-19 in the areas of Paid Sick Leave, Paid Leave to Care for Family Member and tax credits to employers. The shelter-in-place order for all Michigan residents in response to the COVID-19 on was issued by Gov. Gretchen Whitmer on March 23, 2020, requiring all non-essential business and services be temporarily shuttered and all non-essential employees not to report to work.

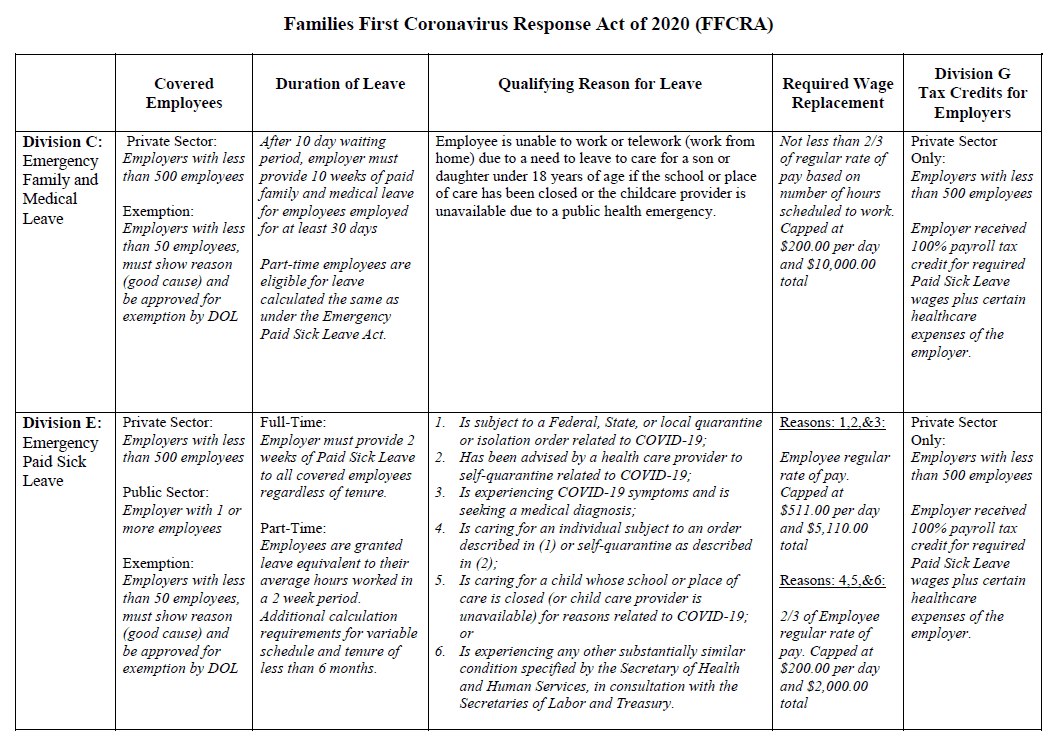

Willis Law has consulted with experts in the labor law area, including the United States Department of Labor Wage and Hour Division (DOL). Through information provided by the DOL, we bring you a few common questions they are receiving in regard to FFCRA. The answers provided by the DOL will help guide the start of your journey through this challenging period. Further, below is a chart that conveniently lays out Divisions C (Emergency Family and Medical Leave) & E (Emergency Paid Sick Leave) of FFCRA.

Frequently Asked Questions

- Does Michigan’s Executive Order 2020-21 (“Shelter in Place”) qualify for two weeks of Emergency Paid Sick Leave under Section 5101 (a)(1) of FFCRA “the employee is subject to a Federal, State, or local quarantine or isolation order related to COVID–19”

No. According to U.S. Department of Labor, Michigan’s Executive Order 2020-21 does not qualify under this provision. This means that in order to qualify for Emergency Paid Sick Leave you must have been diagnosed with COVID-19 and under quarantine/isolation.

- If providing childcare-related paid sick leave and expanded family and medical leave at a business with fewer than 50 employees would jeopardize the viability of that business as a going concern, what is the process take advantage of the small business exemption?

To elect this small business exemption, you should document why your business with fewer than 50 employees meets the criteria set forth by the U.S. Department of Labor. Proper procedures for this will be addressed in more detail in forthcoming regulations from the Department.

- How do count hours worked by a part-time employee for purposes of paid sick leave or expanded family and medical leave?

A part-time employee is entitled to leave for his or her average number of work hours in a two-week period. Therefore, you calculate hours of leave based on the number of hours the employee is normally scheduled to work. If the normal hours scheduled are unknown, or if the part-time employee’s schedule varies, you may use a six-month average to calculate the average daily hours. If this calculation cannot be made because the employee has not been employed for at least six months, use the number of hours that you and your employee agreed that the employee would work upon hiring.

- When calculating pay due to employees, must overtime hours be included?

Yes. The Emergency Family and Medical Leave Expansion Act requires you to pay an employee for hours the employee would have been normally scheduled to work even if that is more than 40 hours in a week. However, the Emergency Paid Sick Leave Act requires that paid sick leave be paid only up to 80 hours over a two-week period. For example, an employee who is scheduled to work 50 hours a week may take 50 hours of paid sick leave in the first week and 30 hours of paid sick leave in the second week. In any event, the total number of hours paid under the Emergency Paid Sick Leave Act is capped at 80.

- As an employee, how much will I be paid while taking paid sick leave or expanded family and medical leave under the FFCRA?

It depends on your normal schedule as well as why you are taking leave. If you are taking paid sick leave because you are unable to work or telework due to a need for leave because you (1) are subject to a Federal, State, or local quarantine or isolation order related to COVID-19; (2) have been advised by a health care provider to self-quarantine due to concerns related to COVID-19; or (3) are experiencing symptoms of COVID-19 and are seeking medical diagnosis, you will receive for each applicable hour the greater of:

- your regular rate of pay,

- the federal minimum wage in effect under the FLSA, or

- the applicable State or local minimum wage.

In these circumstances, you are entitled to a maximum of $511 per day, or $5,110 total over the entire paid sick leave period.

If you are taking paid sick leave because you are: (1) caring for an individual who is subject to a Federal, State, or local quarantine or isolation order related to COVID-19 or an individual who has been advised by a health care provider to self-quarantine due to concerns related to COVID-19; (2) caring for your child whose school or place of care is closed, or child care provider is unavailable, due to COVID-19 related reasons; or (3) experiencing any other substantially-similar condition that may arise, as specified by the Secretary of Health and Human Services, you are entitled to compensation at 2/3 of the greater of the amounts above.

Under these circumstances, you are subject to a maximum of $200 per day, or $2,000 over the entire two-week period. If you are taking expanded family and medical leave, you may take paid sick leave for the first ten days of that leave period, or you may substitute any accrued vacation leave, personal leave, or medical or sick leave you have under your employer’s policy. For the following ten weeks, you will be paid for your leave at an amount no less than 2/3 of your regular rate of pay for the hours you would be normally scheduled to work. The regular rate of pay used to calculate this amount must be at or above the federal minimum wage, or the applicable state or local minimum wage. However, you will not receive more than $200 per day or $12,000 for the twelve weeks that include both paid sick leave and expanded family and medical leave when you are on leave to care for your child whose school or place of care is closed, or child care provider is unavailable, due to COVID-19 related reasons.

- What is my regular rate of pay for purposes of the FFCRA?

For purposes of the FFCRA, the regular rate of pay used to calculate your paid leave is the average of your regular rate over a period of up to six months prior to the date on which you take leave. If you have not worked for your current employer for six months, the regular rate used to calculate your paid leave is the average of your regular rate of pay for each week you have worked for your current employer. If you are paid with commissions, tips, or piece rates, these wages will be incorporated into the above calculation. You can also compute this amount for each employee by adding all compensation that is part of the regular rate over the above period and divide that sum by all hours actually worked in the same period.

- May I take 80 hours of paid sick leave for my self-quarantine and then another amount of paid sick leave for another reason provided under the Emergency Paid Sick Leave Act?

No. You may take up to two weeks—or ten days—(80 hours for a full-time employee, or for a part-time employee, the number of hours equal to the average number of hours that the employee works over a typical two-week period) of paid sick leave for any combination of qualifying reasons. However, the total number of hours for which you receive paid sick leave is capped at 80 hours under the Emergency Paid Sick Leave Act.

- If I am home with my child because his or her school or place of care is closed, or childcare provider is unavailable, do I get paid sick leave, expanded family and medical leave, or both—how do they interact?

You may be eligible for both types of leave, but only for a total of twelve weeks of paid leave. You may take both paid sick leave and expanded family and medical leave to care for your child whose school or place of care is closed, or childcare provider is unavailable, due to COVID-19 related reasons. The Emergency Paid Sick Leave Act provides for an initial two weeks of paid leave. This period thus covers the first ten workdays of expanded family and medical leave, which are otherwise unpaid under the Emergency and Family Medical Leave Expansion Act unless the you elect to use existing vacation, personal, or medical or sick leave under your employer’s policy. After the first ten workdays have elapsed, you will receive 2/3 of your regular rate of pay for the hours you would have been scheduled to work in the subsequent ten weeks under the Emergency and Family Medical Leave Expansion Act.

Please note that you can only receive the additional ten weeks of expanded family and medical leave under the Emergency Family and Medical Leave Expansion Act for leave to care for your child whose school or place of care is closed, or child care provider is unavailable, due to COVID-19 related reasons.

- Can my employer deny me paid sick leave if my employer gave me paid leave for a reason identified in the Emergency Paid Sick Leave Act prior to the Act going into effect?

No. The Emergency Paid Sick Leave Act imposes a new leave requirement on employers that is effective beginning on April 1, 2020.

- Is all leave under the FMLA now paid leave?

No. The only type of family and medical leave that is paid leave is expanded family and medical leave under the Emergency Family and Medical Leave Expansion Act when such leave exceeds ten days. This includes only leave taken because the employee must care for a child whose school or place of care is closed, or childcare provider is unavailable, due to COVID-19 related reasons.

- Are the paid sick leave and expanded family and medical leave requirements retroactive?

No.

Obviously, this list of answers and the above chart are not all encompassing. There will be many changes and many more questions in the days and weeks ahead as the FFCRA is rolled out to the public. Willis Law will put forth every effort to keep you informed and continue to provide an exceptional level of service for all your legal matters and concerns.

Should you have any questions or concerns in the interim, please contact me at (888) 461-7744.

Best Regards,

Willis Law

Meet Your Legal Team

Helping You Achieve the Best Possible Outcome

-

Michael Willis J.D., C.P.A. Director and Co-Founder

Michael Willis J.D., C.P.A. Director and Co-Founder -

Shaun Willis J.D. Director and Co-Founder

Shaun Willis J.D. Director and Co-Founder -

Frank Willis J.D. Chief Senior Counsel

Frank Willis J.D. Chief Senior Counsel -

Donald Smith, J.D. Attorney/Partner

Donald Smith, J.D. Attorney/Partner -

Mariko Willis, J.D. Of Counsel Attorney

Mariko Willis, J.D. Of Counsel Attorney -

Samuel Gilbertson J.D. Managing Partner

Samuel Gilbertson J.D. Managing Partner -

Davis Martin, J.D. Counsel

Davis Martin, J.D. Counsel -

Paul Morgan, J.D. Senior Counsel Attorney

Paul Morgan, J.D. Senior Counsel Attorney -

Chico Obande J.D. Attorney

Chico Obande J.D. Attorney -

Jennifer Grahek, J.D. Attorney

Jennifer Grahek, J.D. Attorney -

Aric Kasel, J.D. Attorney

Aric Kasel, J.D. Attorney -

Cody Hayward, J.D. Attorney

Cody Hayward, J.D. Attorney -

Austin Beaudet Attorney

Austin Beaudet Attorney -

Adam Bancroft, J.D. Counsel

Adam Bancroft, J.D. Counsel -

Verelle Kirkwood J.D. Of Counsel Attorney

Verelle Kirkwood J.D. Of Counsel Attorney -

Kristyn Meulenberg J.D. Of Counsel Attorney

Kristyn Meulenberg J.D. Of Counsel Attorney -

Nicholas Vogelzang Of Counsel Asbestos Litigation Attorney

Nicholas Vogelzang Of Counsel Asbestos Litigation Attorney -

Wally Ferrara Operations Manager

Wally Ferrara Operations Manager -

Robin Vleugel Receptionist

Robin Vleugel Receptionist -

Michele Guyman Paralegal

Michele Guyman Paralegal -

Clare Zemlick Legal Assistant

Clare Zemlick Legal Assistant -

Brian Thompson Paralegal

Brian Thompson Paralegal -

Angela Doster

Angela Doster -

Patty Stickels Legal Assistant

Patty Stickels Legal Assistant -

Kay Davidson Legal Assistant

Kay Davidson Legal Assistant -

Robert Wilson Chief Financial Officer

Robert Wilson Chief Financial Officer -

Mark Zigterman Accountant

Mark Zigterman Accountant -

Margarita Jensen Intake Coordinator

Margarita Jensen Intake Coordinator -

Patrick Willis Courier

Patrick Willis Courier -

Andrew Rann Courier

Andrew Rann Courier -

Rylan Smith Courier

Rylan Smith Courier -

Chris Willis Courier

Chris Willis Courier -

Christian Willis Courier

Christian Willis Courier -

S TSavannah Thompson Legal Assistant

.2410151515171.png)

.2410151522190.png)