Dealing With Creditor Claims in Estate Administration

How to Respond to Creditor Claims in Michigan

The personal representatives (PRs) of estates must notify several interested parties when the testator of a will dies. Notifying known and unknown creditors of the death is one of the first things a PR should do. Once public notice of the testator's death is published, all creditors have 4 months to make claims for repayment against the estate.

Creditors may include lenders, credit card companies, heirs, devises, tax collecting agencies, medical facilities, providers of funeral and burial services, legal service providers, accountants, investment advisers, or a plaintiff in a tort case against the estate. The PR may even be a creditor. Each party requires notice of death by a certain deadline.

When creditors make on-time claims against the estate, you (as the PR) have specific duties:

- First, you must review and scrutinize each claim for all information necessary to possibly pay the debt to the correct party and to validate the basis of the claim.

- The probate court may need to rule as to whether is claim received is an allowed claim.

- If there are enough assets in the estate to cover an allowed claim, you should pay the debt.

- If there are not enough assets to cover the claim, you must notify the creditor of the deficiency.

- At this point, you need an experienced estate and probate administration lawyer as counsel, if you do not already have one. Certain creditors must be paid before others and some creditors not at all, depending on each circumstance.

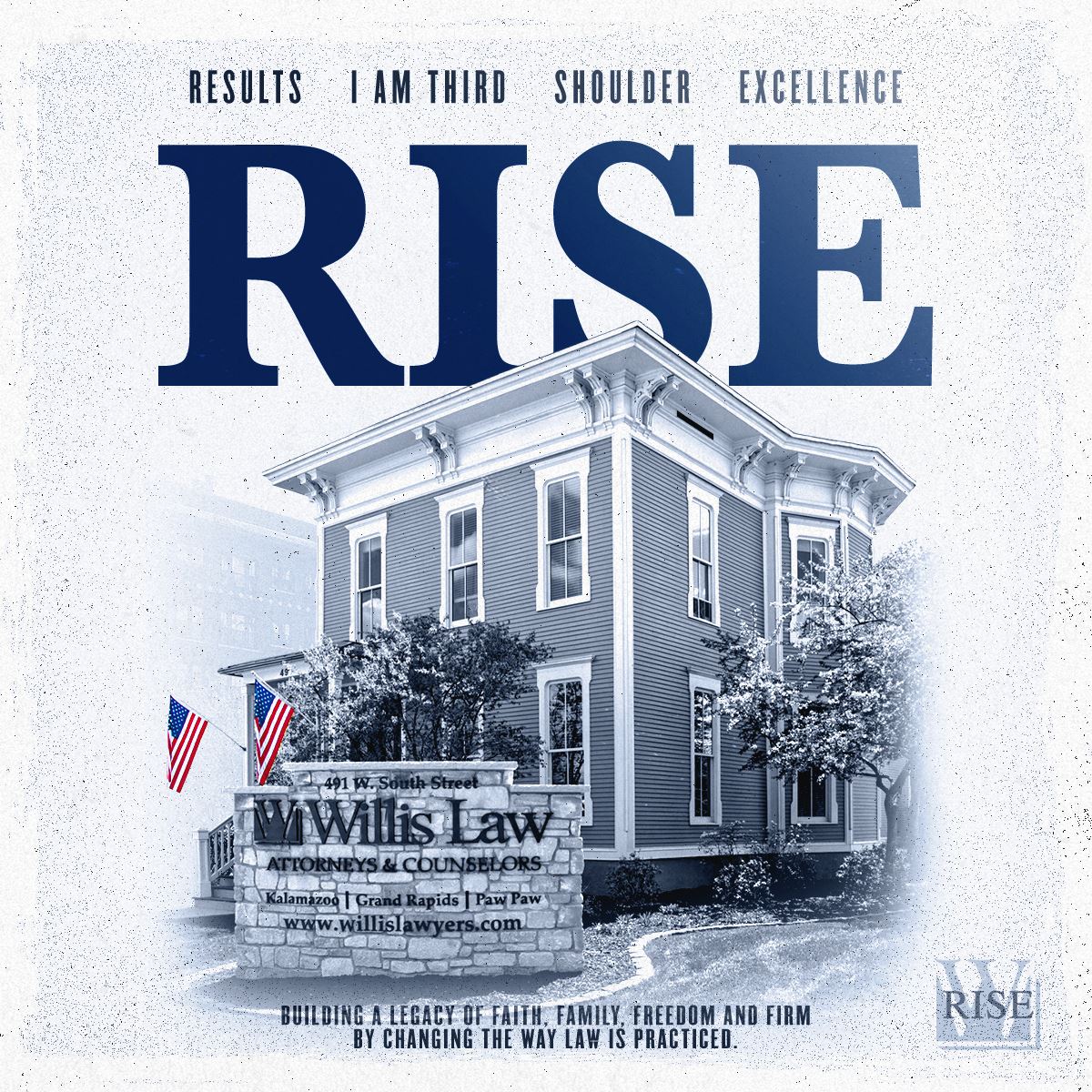

At Willis Law, each year serve hundreds of new clients in the drafting and amending of estate plans, wills and trusts. We serve personal representatives in the state and outside of the state, since every state has specific laws regarding the transfer of property and other assets within its borders that are held in wills and trusts, regardless of in what state the testator dies.

Please call our law firm at (888) 461-7744 to speak with one of our experienced estate administration attorneys today. All initial consultations are free of charge.

We are a team of top-rated attorneys who will provide you with straightforward answers and solutions in all situations.

Note: If you pay any claim prior to the end of the 4-month period (when the ability for creditors to make claims expires) or make a payment that violates the priority order of creditors, you may become personally liable should the estate become insolvent and an allowed claim cannot be paid.

Our services will provide you with peace of mind, legal protections and guidance you can depend on throughout the process of administration.

How Do You Notify Unknown Creditors?

Known creditors are those you will be able to reasonably find evidence of by looking back into the testator's (decedent's) records over the last two years. You will send them letters directly, notifying them of the death and that the estate has been opened.

Unknown creditors are those that you cannot find through reasonable means in a timely manner. This is the purpose of the public notice.

Exactly four months after the public notice is published, unknown creditors will be prevented from filing any claims for repayment of debts and collecting debts from the estate. You will personally be able to tell them that the claims period has expired and the estate is closed.

Speak With One of Our Attorneys at Any Time

With offices in Kalamazoo, Grand Rapids and Paw Paw, we serve clients with interests in estates throughout Western Michigan. Please call us at (888) 461-7744 or email us to schedule a meeting with one of our attorneys.

Meet Your Legal Team

Helping You Achieve the Best Possible Outcome

-

Michael Willis J.D., C.P.A. Director and Co-Founder

Michael Willis J.D., C.P.A. Director and Co-Founder -

Shaun Willis J.D. Director and Co-Founder

Shaun Willis J.D. Director and Co-Founder -

Samuel Gilbertson J.D. Managing Partner

Samuel Gilbertson J.D. Managing Partner -

Davis Martin, J.D. Partner

Davis Martin, J.D. Partner -

Robert Wilson Chief Financial Officer

Robert Wilson Chief Financial Officer -

Donald Smith, J.D. Attorney/Partner

Donald Smith, J.D. Attorney/Partner -

Frank Willis J.D. Chief Senior Counsel

Frank Willis J.D. Chief Senior Counsel -

Paul Morgan, J.D. Senior Counsel Attorney

Paul Morgan, J.D. Senior Counsel Attorney -

Chico Obande J.D. Attorney

Chico Obande J.D. Attorney -

Jennifer Grahek, J.D. Attorney

Jennifer Grahek, J.D. Attorney -

Aric Kasel, J.D. Attorney

Aric Kasel, J.D. Attorney -

Cody Hayward, J.D. Attorney

Cody Hayward, J.D. Attorney -

Austin Beaudet Attorney

Austin Beaudet Attorney -

Mariko Willis, J.D. Of Counsel Attorney

Mariko Willis, J.D. Of Counsel Attorney -

Verelle Kirkwood J.D. Of Counsel Attorney

Verelle Kirkwood J.D. Of Counsel Attorney -

Kristyn Meulenberg J.D. Of Counsel Attorney

Kristyn Meulenberg J.D. Of Counsel Attorney -

Nicholas Vogelzang Of Counsel Asbestos Litigation Attorney

Nicholas Vogelzang Of Counsel Asbestos Litigation Attorney -

Larry Henneman Of Counsel Patent Attorney

Larry Henneman Of Counsel Patent Attorney -

Wally Ferrara Operations Manager

Wally Ferrara Operations Manager -

Michele Guyman Paralegal

Michele Guyman Paralegal -

Brian Thompson Paralegal

Brian Thompson Paralegal -

Justin Bohnett Paralegal

Justin Bohnett Paralegal -

Angela Doster Paralegal

Angela Doster Paralegal -

Clare Zemlick Legal Assistant

Clare Zemlick Legal Assistant -

Patty Stickels Legal Assistant

Patty Stickels Legal Assistant -

Kay Davidson Legal Assistant

Kay Davidson Legal Assistant -

Savannah Thompson Legal Assistant

Savannah Thompson Legal Assistant -

J JJessica Janik Legal Assistant

-

Elizabeth Doolittle Administrative Assistant

Elizabeth Doolittle Administrative Assistant -

Mark Zigterman Accountant

Mark Zigterman Accountant -

Margarita Jensen Intake Coordinator

Margarita Jensen Intake Coordinator -

Patrick Willis Courier

Patrick Willis Courier -

Andrew Rann Courier

Andrew Rann Courier -

Rylan Smith Courier

Rylan Smith Courier -

Chris Willis Courier

Chris Willis Courier -

Christian Willis Courier

Christian Willis Courier -

Zac DeVries Legal Intern

Zac DeVries Legal Intern -

Devin Willis Receptionist

Devin Willis Receptionist -

Alex Lockwood

Alex Lockwood

.2410151515171.png)