Administration of a Small Estate in Michigan

Does the Decedent's Estate Qualify for a Simple Administration Process?

It depends on whether the estate is valued at less than $22,000 after funeral costs, remaining mortgages and any liens on real property are deducted. If the decedent's estate is small enough for this simplified process, you may avoid probate administration, which will allow you to enjoy lesser legal fees and a quicker process of administering the estate.

However, the estate administration will not follow the decedent's will in this process. If you wish to follow the decedent's will, you must file for either the formal or informal probate administration process.

The small estate administration process will divide property by following Michigan's legal formula of inheritance in the following order:

- Surviving spouse, if alive, receives all property.

- Living children of the decedent receive all property, divided equally among them if there is no surviving spouse.

- If a decedent's child died before the decedent, their child(ren) will equally divide what their parent would have received.

- Great grandchildren may also inherit in this manner, if they are the children of a grandchild of the decedent who died before the decedent.

- If there are no living descendants, the decedent's property is split between the decedent's parents equally. If both parents of the decedent are deceased, property in the estate will go to their descendants, starting with the decedent's siblings, then their children and so on, as above.

The formula continues to include the decedent's grandparents, if the decedent's parents are no longer living, and then to aunts and uncles, and finally cousins (you may have heard of a "laughing" cousin). The formula includes several complications and specific rules that should be discussed with an estate administration lawyer.

We recommend that you consult one of our experienced estate administration lawyers in this process for two main reasons:

- There are several important decisions involved with executing the appropriate method for the transfer of assets in the estate. These methods are:

- Assignment of property process, if the decedent's estate includes real property (a probate judge will review and approve the division of property). You must be an heir or the person who paid funeral and burial expenses to proceed, and you must have information on all property and heirs.

- Transfer of affidavit process, if the estate has no real property, you are an heir who will inherit some or all of the estate's property, and you have information on all other heirs. You must wait 28 days after the decedent's death to file for an affidavit to transfer property, and we will help you complete this efficiently.

- Creditor debt collection risk:

- If you file an assignment of property order to distribute all estate property, creditors may still attempt to collect the decedent's debts from heirs for up to 63 days following the signing of the order.

- Similarly, if you file for an affidavit of transfer to distribute all estate property, creditors will have no time limit on debt collection attempts from the heirs.

If you use the small estate administration process, the probate court will not be significantly involved in the process. This process carries some risks, which is why we advise consultation with one of our experienced attorneys, but we are skilled at making this process straightforward and efficient.

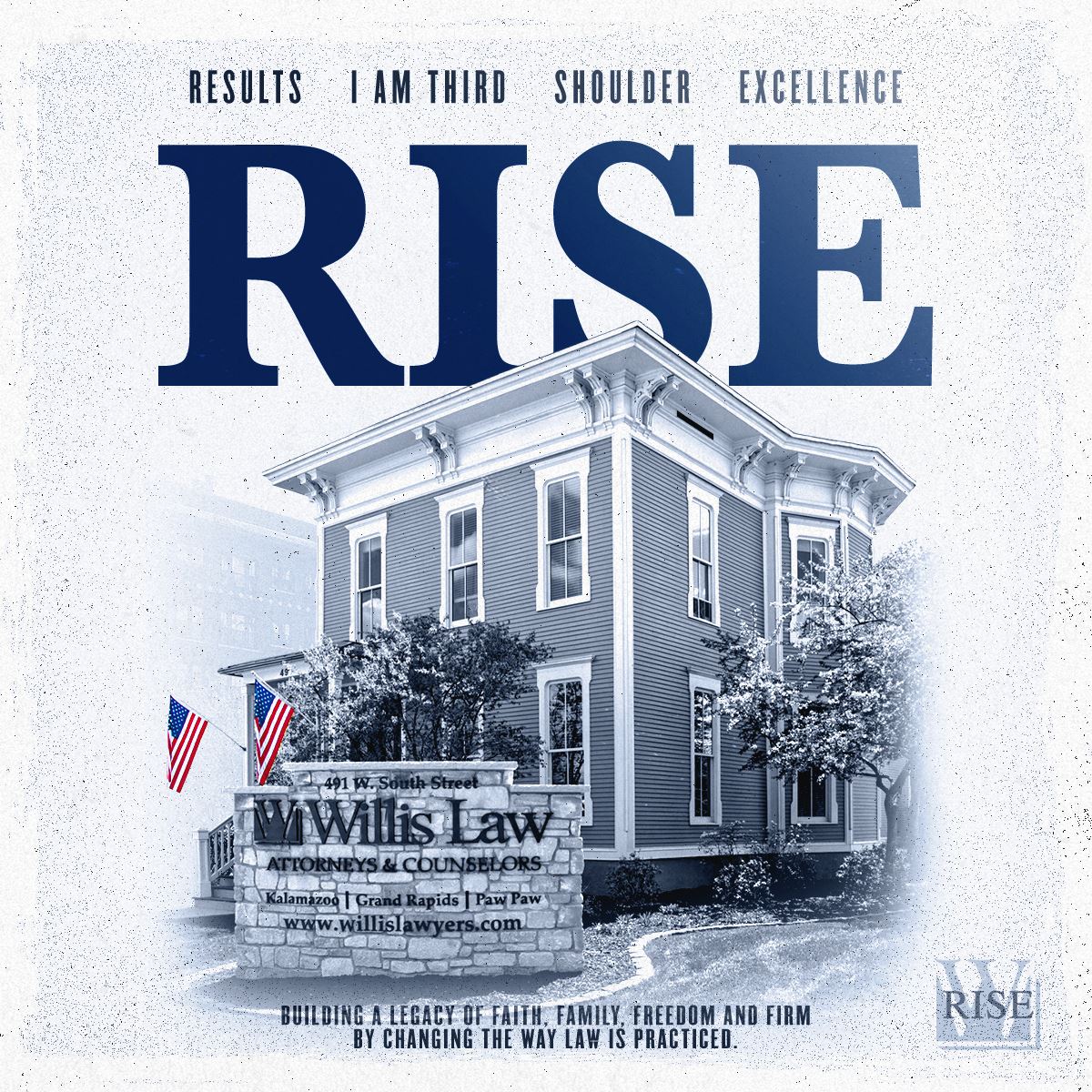

Speak With One of Our Estate Administration Attorneys Today

Please call us toll free at (888) 461-7744 or email our team to schedule a free initial consultation with one of our attorneys in Grand Rapids, Kalamazoo or Paw Paw. We will guide you through the process, protecting your rights and the full assets of the estate.

Meet Your Legal Team

Helping You Achieve the Best Possible Outcome

-

Michael Willis J.D., C.P.A. Director and Co-Founder

Michael Willis J.D., C.P.A. Director and Co-Founder -

Shaun Willis J.D. Director and Co-Founder

Shaun Willis J.D. Director and Co-Founder -

Samuel Gilbertson J.D. Managing Partner

Samuel Gilbertson J.D. Managing Partner -

Davis Martin, J.D. Partner

Davis Martin, J.D. Partner -

Robert Wilson Chief Financial Officer

Robert Wilson Chief Financial Officer -

Donald Smith, J.D. Attorney/Partner

Donald Smith, J.D. Attorney/Partner -

Frank Willis J.D. Chief Senior Counsel

Frank Willis J.D. Chief Senior Counsel -

Paul Morgan, J.D. Senior Counsel Attorney

Paul Morgan, J.D. Senior Counsel Attorney -

Chico Obande J.D. Attorney

Chico Obande J.D. Attorney -

Jennifer Grahek, J.D. Attorney

Jennifer Grahek, J.D. Attorney -

Aric Kasel, J.D. Attorney

Aric Kasel, J.D. Attorney -

Cody Hayward, J.D. Attorney

Cody Hayward, J.D. Attorney -

Austin Beaudet Attorney

Austin Beaudet Attorney -

Mariko Willis, J.D. Of Counsel Attorney

Mariko Willis, J.D. Of Counsel Attorney -

Verelle Kirkwood J.D. Of Counsel Attorney

Verelle Kirkwood J.D. Of Counsel Attorney -

Kristyn Meulenberg J.D. Of Counsel Attorney

Kristyn Meulenberg J.D. Of Counsel Attorney -

Nicholas Vogelzang Of Counsel Asbestos Litigation Attorney

Nicholas Vogelzang Of Counsel Asbestos Litigation Attorney -

Larry Henneman Of Counsel Patent Attorney

Larry Henneman Of Counsel Patent Attorney -

Wally Ferrara Operations Manager

Wally Ferrara Operations Manager -

Michele Guyman Paralegal

Michele Guyman Paralegal -

Brian Thompson Paralegal

Brian Thompson Paralegal -

Justin Bohnett Paralegal

Justin Bohnett Paralegal -

Angela Doster Paralegal

Angela Doster Paralegal -

Clare Zemlick Legal Assistant

Clare Zemlick Legal Assistant -

Patty Stickels Legal Assistant

Patty Stickels Legal Assistant -

Kay Davidson Legal Assistant

Kay Davidson Legal Assistant -

Savannah Thompson Legal Assistant

Savannah Thompson Legal Assistant -

J JJessica Janik Legal Assistant

-

Elizabeth Doolittle Administrative Assistant

Elizabeth Doolittle Administrative Assistant -

Mark Zigterman Accountant

Mark Zigterman Accountant -

Margarita Jensen Intake Coordinator

Margarita Jensen Intake Coordinator -

Patrick Willis Courier

Patrick Willis Courier -

Andrew Rann Courier

Andrew Rann Courier -

Rylan Smith Courier

Rylan Smith Courier -

Chris Willis Courier

Chris Willis Courier -

Christian Willis Courier

Christian Willis Courier -

Zac DeVries Legal Intern

Zac DeVries Legal Intern -

Devin Willis Receptionist

Devin Willis Receptionist -

Alex Lockwood

Alex Lockwood

.2410151515171.png)