What Are the Notice Requirements of a Trustee in Trust Administration?

Michigan Trust Code Notice to Beneficiaries

Whether you are a family member who has been thrust into the position of being the trustee of your parents' trust(s) or an industry professional looking for guidance and assurance in the process of trust administration, our attorneys can help you cross every "t", dot every "i", notify all appropriate parties in a timely manner and shield yourself from personal liability.

As the trustee, you are legally obligated to make the following notifications in trust administration:

- Notify trust beneficiaries and heirs when the grantor (originator) of the trust dies and when there is any change in the method or rate of your compensation.

- Notify creditors when the grantor dies.

- Notify the county assessor when there is a change of ownership in the trust, if the trust contains real estate property

Notice of the grantor's death must be served to all parties who have, or may have, interest in the trust. If you fail to notify any such parties, you may be held liable for related legal actions and costs.

According to Michigan law, you have the duty to keep the trust beneficiaries reasonably informed through reports of trust property (including market value), liabilities, receipts and disbursements (at least annually and at the termination of the trust) and other documents, depending on each beneficiary's status and the composition of the trust's assets.

Consult With Our Lawyers – We Offer Free Initial Consultations

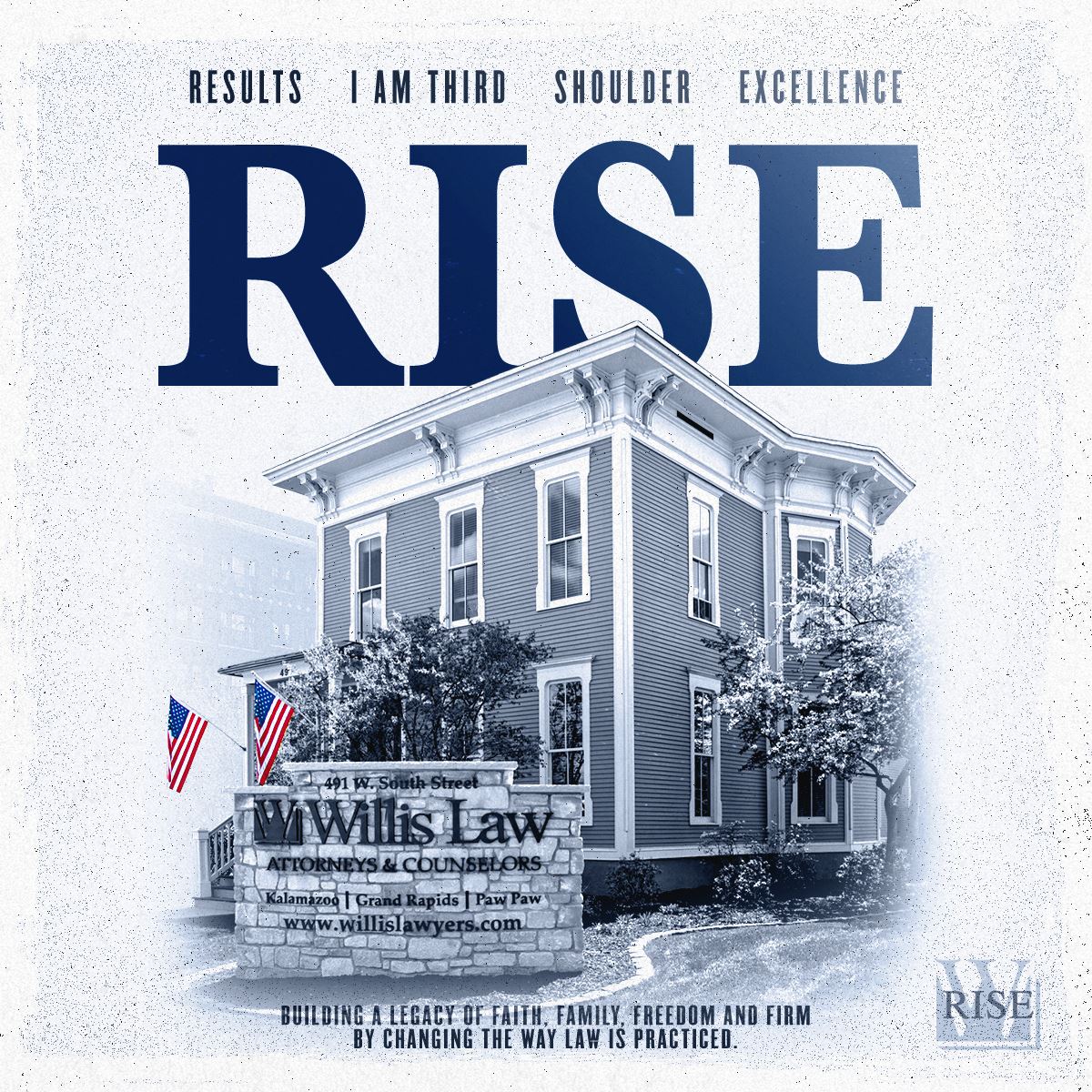

At Willis Law, we serve individuals with little prior experience as trustees, people who have been the trustee or executor of a loved one's estate for years, and professionals who need help with complex legal matters involving trust administration.

We are here to help you, and we will do so with unwavering ethics and efficient, effective legal work. Please call us toll free at (888) 461-7744 or email us to schedule a meeting with one of our experienced lawyers at our offices in Kalamazoo, Grand Rapids or Paw Paw. We look forward to speaking with you.

Meet Your Legal Team

Helping You Achieve the Best Possible Outcome

-

Michael Willis J.D., C.P.A. Director and Co-Founder

Michael Willis J.D., C.P.A. Director and Co-Founder -

Shaun Willis J.D. Director and Co-Founder

Shaun Willis J.D. Director and Co-Founder -

Samuel Gilbertson J.D. Managing Partner

Samuel Gilbertson J.D. Managing Partner -

Davis Martin, J.D. Partner

Davis Martin, J.D. Partner -

Robert Wilson Chief Financial Officer

Robert Wilson Chief Financial Officer -

Donald Smith, J.D. Attorney/Partner

Donald Smith, J.D. Attorney/Partner -

Frank Willis J.D. Chief Senior Counsel

Frank Willis J.D. Chief Senior Counsel -

Paul Morgan, J.D. Senior Counsel Attorney

Paul Morgan, J.D. Senior Counsel Attorney -

Chico Obande J.D. Attorney

Chico Obande J.D. Attorney -

Jennifer Grahek, J.D. Attorney

Jennifer Grahek, J.D. Attorney -

Aric Kasel, J.D. Attorney

Aric Kasel, J.D. Attorney -

Cody Hayward, J.D. Attorney

Cody Hayward, J.D. Attorney -

Austin Beaudet Attorney

Austin Beaudet Attorney -

Mariko Willis, J.D. Of Counsel Attorney

Mariko Willis, J.D. Of Counsel Attorney -

Verelle Kirkwood J.D. Of Counsel Attorney

Verelle Kirkwood J.D. Of Counsel Attorney -

Kristyn Meulenberg J.D. Of Counsel Attorney

Kristyn Meulenberg J.D. Of Counsel Attorney -

Nicholas Vogelzang Of Counsel Asbestos Litigation Attorney

Nicholas Vogelzang Of Counsel Asbestos Litigation Attorney -

Larry Henneman Of Counsel Patent Attorney

Larry Henneman Of Counsel Patent Attorney -

Wally Ferrara Operations Manager

Wally Ferrara Operations Manager -

Michele Guyman Paralegal

Michele Guyman Paralegal -

Brian Thompson Paralegal

Brian Thompson Paralegal -

Justin Bohnett Paralegal

Justin Bohnett Paralegal -

Angela Doster Paralegal

Angela Doster Paralegal -

Clare Zemlick Legal Assistant

Clare Zemlick Legal Assistant -

Patty Stickels Legal Assistant

Patty Stickels Legal Assistant -

Kay Davidson Legal Assistant

Kay Davidson Legal Assistant -

Savannah Thompson Legal Assistant

Savannah Thompson Legal Assistant -

J JJessica Janik Legal Assistant

-

Elizabeth Doolittle Administrative Assistant

Elizabeth Doolittle Administrative Assistant -

Mark Zigterman Accountant

Mark Zigterman Accountant -

Margarita Jensen Intake Coordinator

Margarita Jensen Intake Coordinator -

Patrick Willis Courier

Patrick Willis Courier -

Andrew Rann Courier

Andrew Rann Courier -

Rylan Smith Courier

Rylan Smith Courier -

Chris Willis Courier

Chris Willis Courier -

Christian Willis Courier

Christian Willis Courier -

Zac DeVries Legal Intern

Zac DeVries Legal Intern -

Devin Willis Receptionist

Devin Willis Receptionist -

Alex Lockwood

Alex Lockwood

.2410151515171.png)