Asset Protection Trust Michigan

Kalamazoo Asset Protection Attorneys

On March 8th, 2017, the Qualified Dispositions in Trust Act became law in Michigan. Heralded as Michigan’s effort to move its estate planning and trust laws to the front of the country, the law affords an individual the ability to protect assets from his or her own creditors through a specialized, irrevocable, and self-titled living trust. An Asset Protection Trust (APT) takes control of assets out of the grantor’s hands, and thus, out of range of his or her own personal creditors.

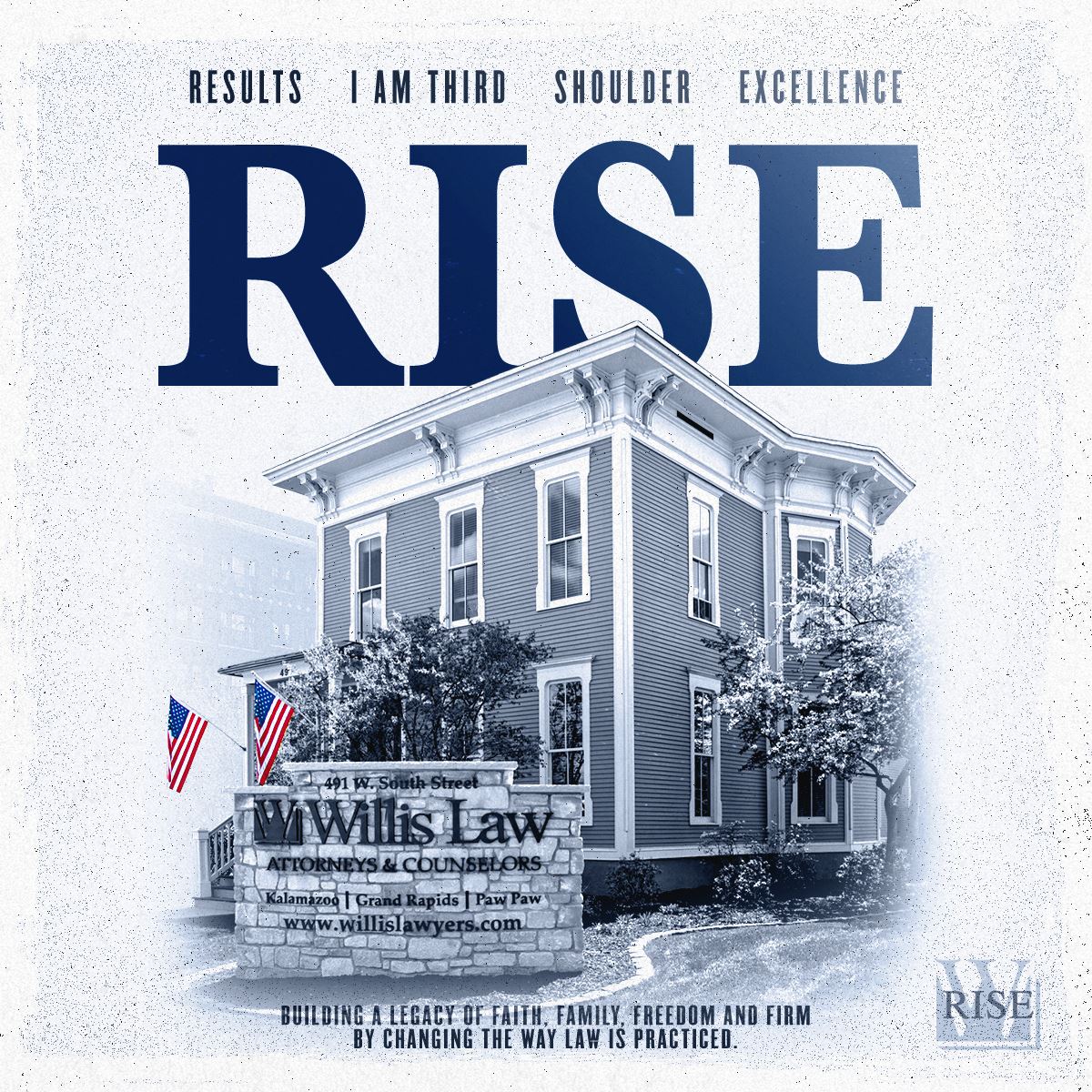

Using Michigan asset protection options and creating an effective APT can be a complicated process. Let Willis Law and our trust attorneys in Grand Rapids be your legal guides. Our legal team has received and achieved numerous noteworthy recognitions, including selection to Best Lawyers in America®, Super Lawyers® and an AV Preeminent® Rating by Martindale-Hubbell®.

Call our Kalamazoo asset protection attorneys at (888) 461-7744 or email us for more information about Michigan asset protection trusts.

Qualifications & Details About Asset Protection Trusts Michigan

Not just any individual can use an asset protection trust in Michigan to shield certain assets from creditors that would collect them in the event of bankruptcy or other defaults. For a trust to qualify in Michigan for this specialized purpose, it must incorporate Michigan law, include a Michigan-approved trustee, and be filed along with an affidavit that explicitly states that no attempts to defraud creditors are being made by the grantor. Additionally, the creator of the trust may not be the trustee, but is permitted to direct investments, receive income through the trust, and use veto powers against distributions.

An APT could be formed as a:

- Charitable Remainder Trust

- Discretionary Trust

- Grantor Retained Annuity Trust

- Qualified Personal Resident Trust

- Support, Health, Maintenance, or Education Trust

Any trust that qualifies to be considered an APT will essentially block any creditor actions against the assets contained within. Creditors that wish to claim assets of an APT will need to prove that there was real and intentional action taken to commit fraud by sealing the assets.

Combining Estate Planning Techniques to Your Benefit

An Asset Protection Trust can be incredibly useful to hold onto your assets when it is paired with other estate planning tools. Our Kalamazoo asset protection lawyers recommend APT use for professionals that may be at high risk of liability due to the nature of their work, such as physicians, accountants, financial advisers, corporate officers, and business owners. Keep in mind that an APT is irrevocable and inflexible, so any transferred assets will be surrendered without the chance of future control.

Learn more about Michigan asset protection by contacting our law firm today at (888) 461-7744. There may be an APT option that works for you!

Meet Your Legal Team

Helping You Achieve the Best Possible Outcome

-

Michael Willis J.D., C.P.A. Director and Co-Founder

Michael Willis J.D., C.P.A. Director and Co-Founder -

Shaun Willis J.D. Director and Co-Founder

Shaun Willis J.D. Director and Co-Founder -

Samuel Gilbertson J.D. Managing Partner

Samuel Gilbertson J.D. Managing Partner -

Davis Martin, J.D. Partner

Davis Martin, J.D. Partner -

Robert Wilson Chief Financial Officer

Robert Wilson Chief Financial Officer -

Donald Smith, J.D. Attorney/Partner

Donald Smith, J.D. Attorney/Partner -

Frank Willis J.D. Chief Senior Counsel

Frank Willis J.D. Chief Senior Counsel -

Paul Morgan, J.D. Senior Counsel Attorney

Paul Morgan, J.D. Senior Counsel Attorney -

Chico Obande J.D. Attorney

Chico Obande J.D. Attorney -

Jennifer Grahek, J.D. Attorney

Jennifer Grahek, J.D. Attorney -

Aric Kasel, J.D. Attorney

Aric Kasel, J.D. Attorney -

Cody Hayward, J.D. Attorney

Cody Hayward, J.D. Attorney -

Austin Beaudet Attorney

Austin Beaudet Attorney -

Mariko Willis, J.D. Of Counsel Attorney

Mariko Willis, J.D. Of Counsel Attorney -

Verelle Kirkwood J.D. Of Counsel Attorney

Verelle Kirkwood J.D. Of Counsel Attorney -

Kristyn Meulenberg J.D. Of Counsel Attorney

Kristyn Meulenberg J.D. Of Counsel Attorney -

Nicholas Vogelzang Of Counsel Asbestos Litigation Attorney

Nicholas Vogelzang Of Counsel Asbestos Litigation Attorney -

Larry Henneman Of Counsel Patent Attorney

Larry Henneman Of Counsel Patent Attorney -

Wally Ferrara Operations Manager

Wally Ferrara Operations Manager -

Michele Guyman Paralegal

Michele Guyman Paralegal -

Brian Thompson Paralegal

Brian Thompson Paralegal -

Justin Bohnett Paralegal

Justin Bohnett Paralegal -

Angela Doster Paralegal

Angela Doster Paralegal -

Clare Zemlick Legal Assistant

Clare Zemlick Legal Assistant -

Patty Stickels Legal Assistant

Patty Stickels Legal Assistant -

Kay Davidson Legal Assistant

Kay Davidson Legal Assistant -

Savannah Thompson Legal Assistant

Savannah Thompson Legal Assistant -

J JJessica Janik Legal Assistant

-

Elizabeth Doolittle Administrative Assistant

Elizabeth Doolittle Administrative Assistant -

Mark Zigterman Accountant

Mark Zigterman Accountant -

Margarita Jensen Intake Coordinator

Margarita Jensen Intake Coordinator -

Patrick Willis Courier

Patrick Willis Courier -

Andrew Rann Courier

Andrew Rann Courier -

Rylan Smith Courier

Rylan Smith Courier -

Chris Willis Courier

Chris Willis Courier -

Christian Willis Courier

Christian Willis Courier -

Zac DeVries Legal Intern

Zac DeVries Legal Intern -

Devin Willis Receptionist

Devin Willis Receptionist -

Alex Lockwood

Alex Lockwood

.2410151515171.png)